Exception-Based Reporting

A Perficient Strategic Position

Reinvent Finance Reporting With an Exception-Based Approach

What is Exception-Based Reporting (EBR)?

Exception-based reporting (EBR) is a data analysis approach that detects deviations between actual performance and expected outcomes. The goal is to identify anomalies before they pose a potential risk.

The foundation of management reporting lies in EBR. Without it, identifying trends becomes challenging.

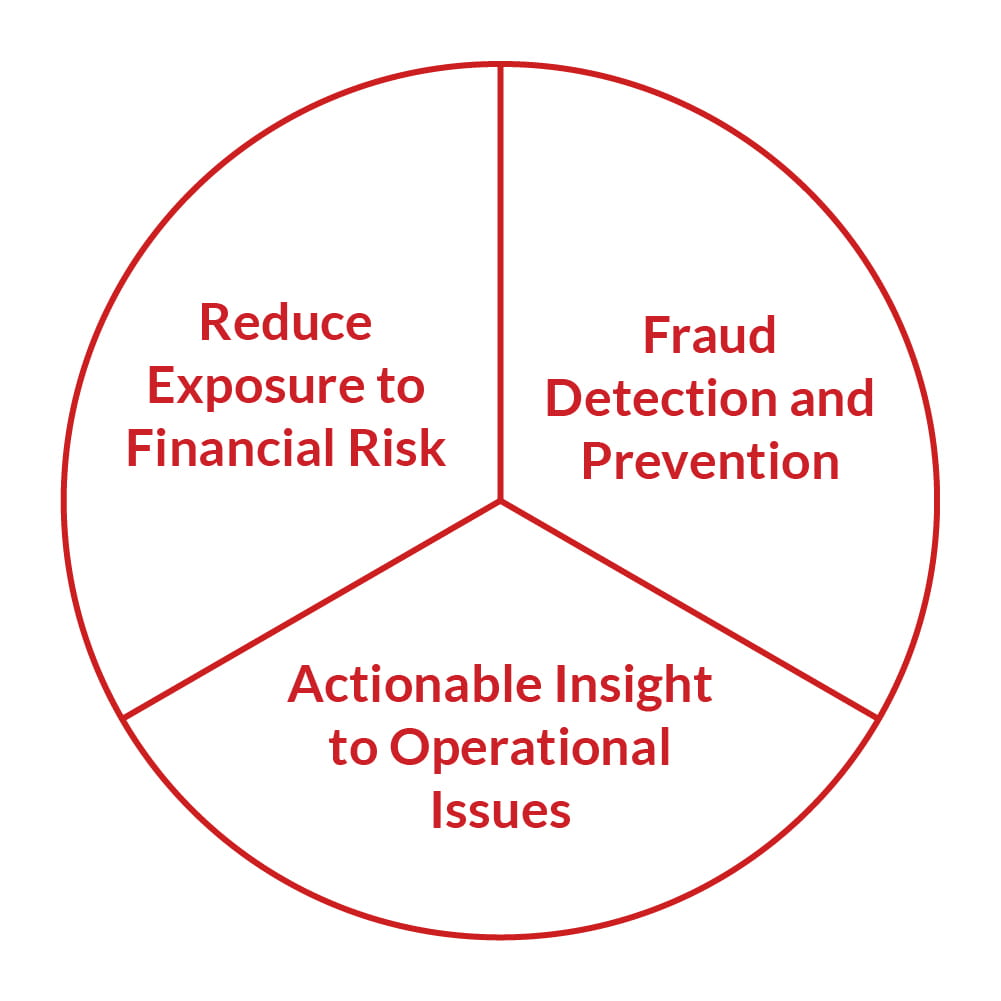

While EBR is a well-established tool for preventing fraud and loss in certain industries, such as retail, it is frequently overlooked as a method of reporting. By analyzing data for exceptions against expected outcomes, EBR can provide CFOs and their teams valuable insights into performance trends and risks.

EBR for finance identifies key metrics that tell the story of business performance and compares them to expected outcomes, including historical deviation and forecasts.

Analyzing exceptions can be extended to sales, operational expense management, and working capital to provide insight to performance attainment.

EBR can provide regular updates to leadership on sales, costs, and working capital to guide decision making and drive daily, weekly, and monthly performance.